Business Valuation

Why take this course?

🎉 Mastering Business Valuation: A Comprehensive Guide 🌟

Course Title: Business Valuation

Course Headline: 📊 Unlock the Secrets of Valuing a Business with Expertise and Confidence 🏦

Your Journey to Business Valuation Mastery Begins Here!

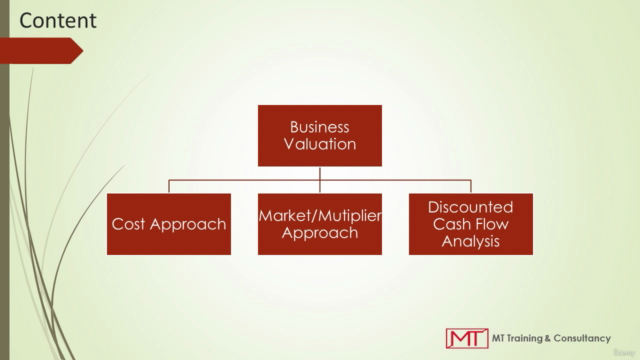

Dive into the fascinating world of Business Valuation with our expert-led course designed to equip you with the foundational knowledge and skills needed to appraise businesses effectively. Whether you're a finance professional, an entrepreneur, or an investor looking to expand your expertise, this course will provide you with a solid understanding of the three main valuation methods:

- Cost Approach 🏗️

- Multiplier Approach 🔄

- Discounted Cash Flow Analysis (DCF) 💸

Course Highlights:

-

Foundational Knowledge: Grasp the basic appraisal concepts and essential terminology with clear explanations and practical examples.

-

Valuation Methods: Learn how to apply each of the three main approaches for valuation with real-life scenarios, enhancing your ability to understand and execute complex valuations.

-

Real-World Case Studies: Analyze case studies from global firms such as Microsoft, WhatsApp, and China Unicom to see these concepts in action.

Key Topics Covered:

-

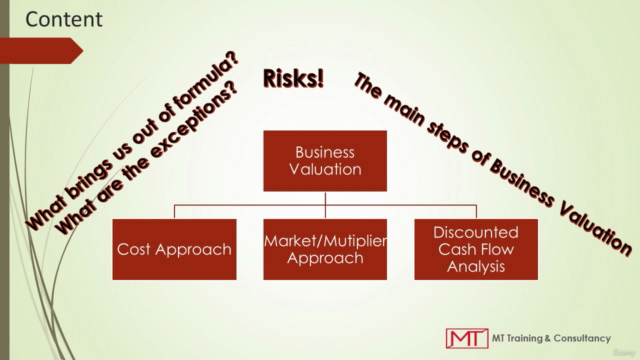

Understanding Risk Premiums 📈

- Determine the discount rate, growth rate, and terminal year in DCF analysis.

-

Financial Analysis & Adjustments: Learn how to make necessary adjustments to the company's financial statements for a more accurate valuation.

-

Calculating Fair Value 💡

- Master the use of Earnings Multiples, Equity Multiples, and Sales Multiples to calculate Fair Value.

-

Valuation Terms & Concepts: Get familiar with key terms such as Premise of Value, Enterprise Value, Going-Concern Value, Liquidation Value, and Market Capitalization.

-

Enterprise Value & Liquidation Value Calculations 📊

- Understand how to calculate and use these critical values in your valuation analysis.

Practical Skills You Will Acquire:

-

Valuation Process: Understand the main steps of the valuation process, including choosing the appropriate valuation approach.

-

Decision Making: Learn to evaluate both the story behind the company and the numbers for a comprehensive business valuation conclusion.

Who Should Take This Course?

This course is ideal for:

- Finance Professionals seeking to enhance their business valuation expertise.

- Entrepreneurs looking to understand the value of their own businesses.

- Investors aiming to evaluate potential investments with greater precision and confidence.

- Students aspiring to pursue a career in finance or corporate development.

Embark on your journey towards becoming a business valuation expert today! With our comprehensive course, you'll gain the practical skills and theoretical knowledge necessary to conduct accurate and insightful business appraisals. 🚀

Enroll now and transform the way you understand and approach business valuation!

Course Gallery

Loading charts...