Building Blocks of a DCF Valuation

Why take this course?

🎉 Course Title: Building Blocks of a DCF Valuation

Unlock the Secrets of Business Valuation with DCF!

🚀 Course Headline: Importance of DCF Valuations in Finance

Dive into the World of Discounted Cash Flow (DCF) Valuations!

🔍 What You'll Learn:

-

The Fundamentals of DCF: Understand the underlying principles and applications of DCF valuation in various financial scenarios.

-

Industry Applications: Explore how DCF is utilized by Hedge Funds, Equity Research teams, and Investment Banks to assess company value.

-

Valuation Across Sectors: Learn why both private and public companies rely on DCF for strategic decision-making and investor relations.

-

Critical Financial Insight: Discover the importance of DCF valuations in providing a forward-looking perspective on a company's worth.

Why Mastering DCF is Essential:

-

Informed Decision Making: Gain the knowledge to make informed investment decisions and understand the true value of a business.

-

Strategic Financial Planning: Learn how DCF analysis can be leveraged for long-term planning, including mergers and acquisitions.

-

Risk Assessment: Understand how to use DCF models to evaluate risk and return in various economic conditions.

Who Should Take This Course:

This course is designed for:

-

Aspiring Analysts: If you're aiming to break into the field of finance, mastering DCF is a must.

-

Current Financial Professionals: Elevate your skill set and enhance your analytical capabilities with advanced DCF knowledge.

-

Entrepreneurs & Business Owners: Learn how to value your own business and understand what investors might consider when evaluating your company.

Course Structure:

-

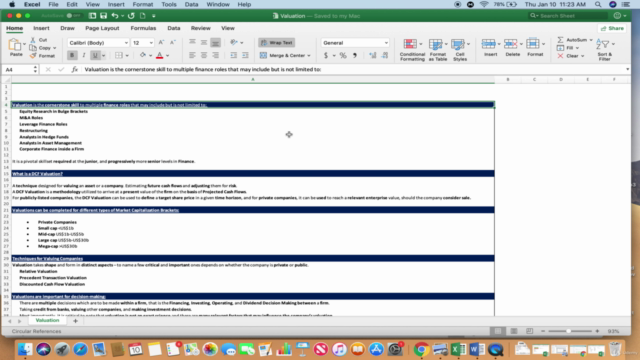

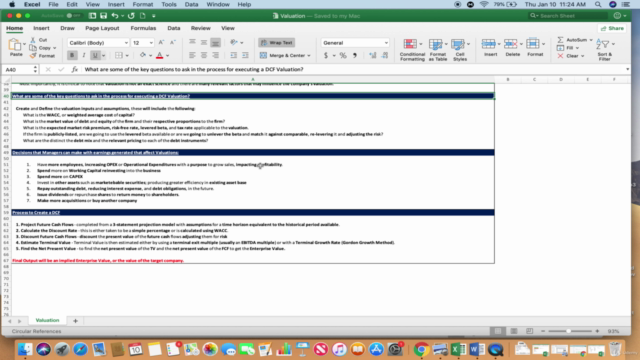

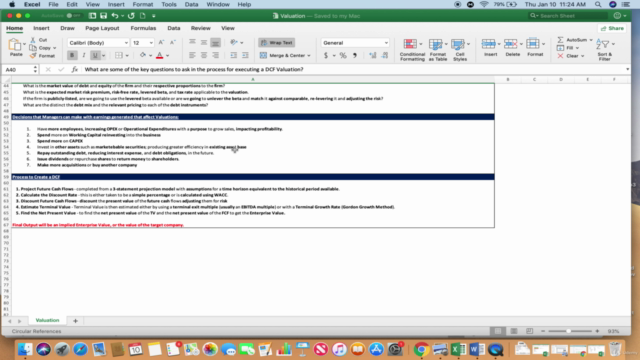

Introduction to DCF Valuation: We'll start by laying the foundation of what a DCF valuation is and its significance in financial analysis.

-

DCF in Different Financial Settings: You'll learn how DCF is applied in various scenarios, including valuing startups, growth companies, and established businesses.

-

The Components of a DCF Model: We'll break down the key components required to build a robust DCF model.

-

Real-World Applications: Case studies will help you apply your newfound knowledge in real-world contexts.

No Calculations, All Understanding:

While we won't be crunching numbers or performing complex calculations, this course will give you a comprehensive understanding of the DCF methodology and its significance in finance. You'll come away with a clear grasp of how to interpret and use DCF valuations in your professional journey.

Enroll now to become proficient in one of the most crucial skills in modern finance! 💼💡🚀

Course Gallery

Loading charts...