Build a Trading Comps Valuation Model

Why take this course?

🌟 Course Title: Build a Trading Comps Valuation Model

🚀 Headline: Learn to build and analyze the single most common model in investment banking!

Unlock the Secrets of Comps Analysis in Finance!

Are you aiming to master one of the most critical skills in investment banking and finance? Look no further! Our "Build a Trading Comps Valuation Model" course is tailored for you. Dive deep into the world of comparables analysis, the bedrock of valuation models used by financial professionals around the globe.

Why Choose This Course?

- Industry-Standard Methodology: Master the most widely used valuation methodology in investment banking.

- Real-World Application: Utilize a real case study to apply what you learn, just as it's done at top financial institutions.

- Expert Guidance: Learn from an experienced course instructor who brings a wealth of knowledge and practical insights.

Course Highlights:

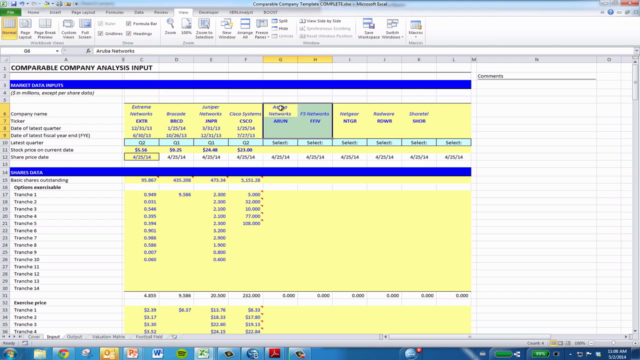

✅ Hands-On Learning: Build a complete comps model in Excel from scratch, gaining invaluable hands-on experience.

✅ Real Case Study: Apply your skills to a real case study, allowing you to see the application of your new knowledge in a practical context.

✅ Step-by-Step Instructions: From selecting appropriate comparables to calculating financial ratios and interpreting them, our course breaks down each step for you.

🔹 Detailed Lesson Breakdown:

-

Selecting Appropriate Comparables: Evaluate operational, financial, size, and other similarities to choose the best comps.

-

Setting Evaluation Benchmarks: Learn how to establish benchmarks for your analysis.

-

Gathering Financial Data: Collect historical and projected financial data necessary for your model.

-

Normalizing Results: Understand how to normalize operating results and calculate Last Twelve Months (LTM) operating results.

-

Standardizing Expenses: Standardize various expense classifications, including converting from FIFO to LIFO inventory accounting.

-

Calculating Shares Outstanding: Learn the treasury stock method for calculating shares outstanding.

-

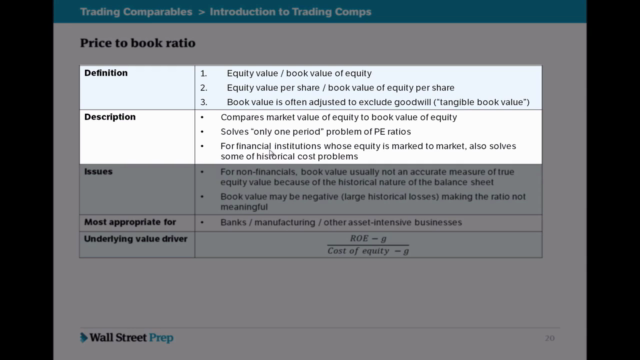

Inputting Financial Data: Input financial data accurately and calculate essential financial and market ratios.

-

Interpreting Outputs: Structure output schedules and present your trading comps in a compelling manner.

-

Selecting Valuation Multiples: Use the VLOOKUP function to select key valuation multiples and generate multiple tables for comparison.

By completing this course, you will have a comprehensive understanding of how to build a trading comps model and analyze it effectively. You'll be equipped with the skills to confidently value companies and make informed financial decisions.

Whether you're an aspiring investment banker, a finance professional, or someone looking to add a powerful tool to your skillset, this course is your gateway to becoming proficient in one of the most critical aspects of valuation analysis.

Enroll now to start building your trading comps model and take the first step towards financial expertise! 🚀✨

Course Gallery

Loading charts...