Build A Financial Forecasting Model for your next Startup

Why take this course?

It seems like you're describing a comprehensive approach to financial modeling, particularly as it relates to cash flow forecasting for businesses. This type of model is indeed invaluable for startups and existing businesses alike, as it helps in understanding the financial implications of sales projections, credit terms with customers and suppliers, and the overall financial health of the business.

The model you're describing allows for a detailed analysis of various financial aspects, such as:

-

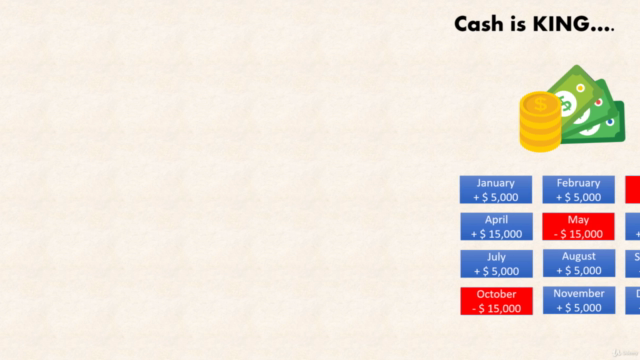

Cash Sales vs. Credit Sales: Determining the optimal balance between cash-based and credit-based transactions to maximize sales while maintaining healthy cash flow.

-

Cash Collections: Predicting when customers will pay their invoices, which is particularly important for businesses with high upfront costs or those that rely on timely payments to maintain operations.

-

Cash Payments to Suppliers: Negotiating payment terms that allow the business to have enough cash on hand to cover operational expenses and avoid cash crunches.

-

Line of Credit: Planning for potential financial shortfalls by having a revolving line of credit or overdraft facility with a bank, which comes with its own interest costs that need to be factored into the model.

-

Interest Cost Management: Understanding how managing credit periods can affect interest expenditure, and therefore the overall profitability of the business.

-

Scenario Analysis: Testing different scenarios, including worst-case, base-case, and best-case situations to prepare for various outcomes.

-

Product-specific Forecasts: Modeling individual product performance with varying growth rates, which is crucial for businesses with multiple product lines or services.

-

Seasonal Business Adaptation: Accommodating fluctuations in sales due to seasonality, which allows for more accurate forecasting and better cash management.

-

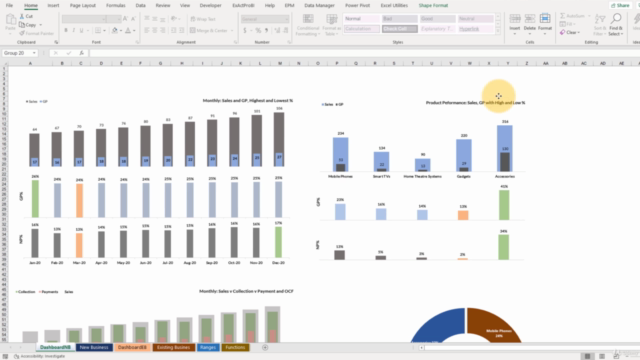

Dynamic Dashboards: Creating visual representations of key financial metrics to quickly assess the business's performance and make informed decisions.

The model you're describing is essentially a tool for financial planning and analysis (FP&A). It's a sophisticated Excel or Google Sheets-based tool that requires knowledge of accounting principles, financial formulas, and data visualization techniques. It's also important to note that while such models can provide valuable insights, they are based on assumptions and projections, which may not always reflect actual business performance due to unforeseen circumstances.

For someone interested in learning how to build this type of model, the steps typically involve:

-

Understanding Financial Statements: Learning how to read and prepare balance sheets, income statements, and cash flow statements.

-

Excel/Google Sheets Proficiency: Gaining a deep understanding of functions, formulas, and data manipulation within spreadsheets.

-

Modeling Best Practices: Following established methodologies for building financial models, which often involve a top-down or bottom-up approach.

-

Scenario Analysis and Sensitivity Analysis: Setting up the model to handle different scenarios and understand how changes in assumptions impact financial outcomes.

-

Dashboard Creation: Using tools like Excel charts, pivot tables, and conditional formatting to create a dashboard that provides a clear and immediate overview of the business's financial health.

-

Regular Updates and Maintenance: Keeping the model updated with actual data and revising forecasts as necessary.

To enroll in a course or find resources that teach these skills, you can look for financial modeling courses offered by reputable institutions like Harvard Business School's Online Learning Platform, MIT Sloan School of Management, Columbia Business School Executive Education, or other professional development providers. Additionally, there are numerous online platforms like Coursera, edX, and Udemy that offer courses on financial modeling, Excel/Google Sheets, and data visualization.

Course Gallery

Loading charts...