Basics of Microfinance

Why take this course?

🌱 Basics of Microfinance: Concept of Microcredits and Microfinance 🌱

Welcome to the fascinating world of Microfinance, a pivotal tool in empowering low-income households across the globe. This comprehensive online course, crafted by the esteemed Dr. Saroj Dhake Pravinchand, will be your gateway to understanding the intricacies and impact of microfinance.

🚀 Course Headline: Concept of Microcredits and Microfinance

📘 Course Description:

Microfinance is more than a financial service; it's a lifeline for millions, offering them the opportunity to lift themselves out of poverty through access to credit and other financial services. This course is designed to provide you with a solid foundation in microfinance, guiding you through its various dimensions, including:

- The Fundamentals: Explore the concept of microcredits and how they serve as a stepping stone for economic inclusion.

- Products of Microfinance: Discover the array of products tailored to meet the needs of low-income individuals – from loans to savings, insurance, and more.

- NABARD Initiatives: Learn about the initiatives taken by National Bank for Agriculture and Rural Development (NABARD) in India, which play a crucial role in shaping microfinance policies and practices.

- Microfinance in Sustainable Development: Understand the critical role that microfinance plays in promoting sustainable development goals and how it contributes to poverty alleviation.

- Emerging Opportunities: As we strive to achieve the Sustainable Developments Goals by 2030, this course will introduce you to new opportunities in microfinance that cater to these unique challenges.

🌍 Key Takeaways:

- Gain insights into the global landscape of microfinance and its significance in economic development.

- Learn about the various microfinance products available and how they're structured to meet the needs of different client segments.

- Explore case studies from India, a leading nation in implementing microfinance solutions.

- Understand the role of policy frameworks, regulations, and governance structures that support microfinance initiatives.

- Discuss the intersection of technology and microfinance, and how innovation can lead to more inclusive financial services.

🎓 Who Should Take This Course?

Whether you're a finance professional looking to expand your expertise into the microfinance domain, an aspiring entrepreneur interested in microfinance institutions (MFIs), or a student of economics and development studies, this course offers valuable insights for all.

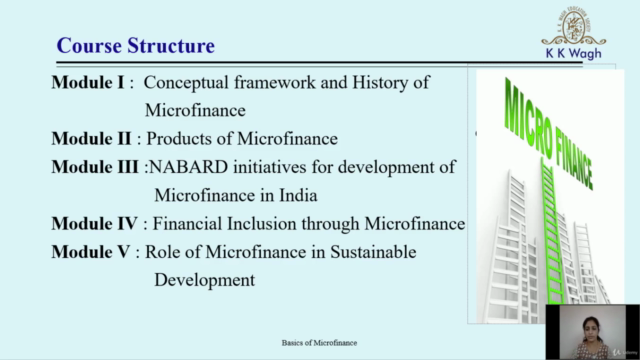

📅 Course Structure:

The course is structured into interactive modules that cover:

- The evolution and history of microfinance.

- Key players and stakeholders in the microfinance sector.

- Impact assessments and best practices.

- Regulatory environment and compliance standards.

- Real-world challenges and case studies.

By the end of this course, you'll not only have a comprehensive understanding of microfinance but also be equipped with the knowledge to contribute meaningfully to this dynamic sector. Enroll now to join a community of learners and professionals who are shaping the future of financial inclusion! 🌟

Course Gallery

Loading charts...