Basel Norms ( Basel 1 / Basel 2 / Basel 3 ) Masterclass

Why take this course?

🧠 Master Basel Norms 1,2 & 3 with Practical Case Studies of Banks

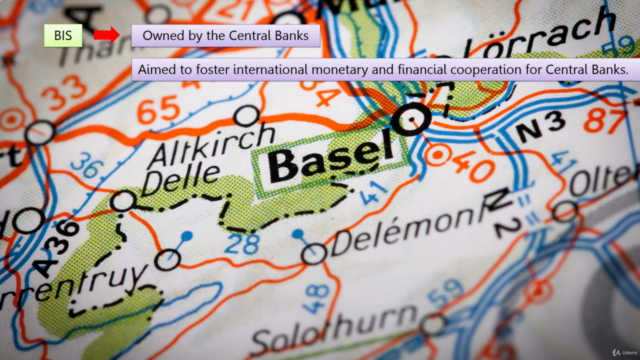

🚀 Course Overview: This Masterclass is a deep dive into the world of banking regulations, offering an in-depth understanding of the Basel Norms (Basel 1 / Basel 2 / Basel 3). You'll journey through the historical context and evolution of these standards, learning how they influence capital adequacy, risk management, and the overall stability of the financial system.

📚 What you will learn:

Basel 1:

- 🏦 What are Banking Regulations?

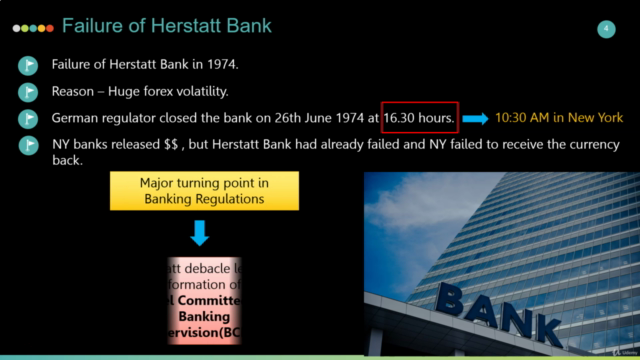

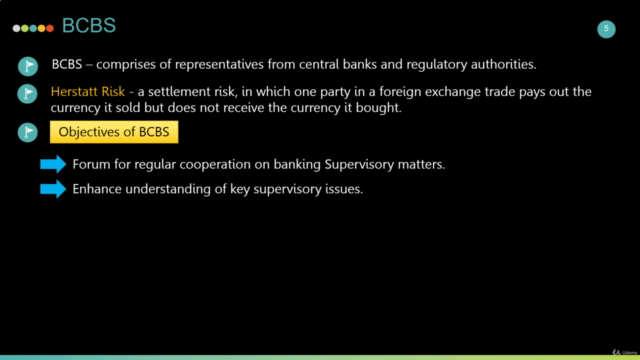

- 🚀 Why Basel 1 Accords?

- 💰 Treatment of Capital under Basel 1

- ⚖️ Risk Weighted Assets and their significance

- 🔧 The Capital Adequacy Ratio explained

- 📈 Benefits and Limitations of Basel 1

- 🌐 Incorporating Market Risk into the Framework

Basel 2:

- 🤔 Why Basel 2? Understanding the necessity

- 🏢 The Structure and Objectives of Basel 2

- 💰 Capital Adequacy Ratio with a practical Case Study of ICICI Bank

- 🚫 Operational Risk Calculation using Basic Indicator Approach (BIA)

- 🌍 Standardized Approach (TSA) vs Advanced Measurement Approach (AMA)

- 📊 Market Risk Calculation under Basel 2 with a Case Study

- 💳 Credit Risk Calculation using The Standardised Approach (TSA) with a Case Study

- 🔍 Internal Ratings Based Approach for Credit Risk with a Case Study

Basel 3:

- 🧠 Why Basel 3? Understanding the post-financial crisis response

- 🏗️ The Structure and Key Changes introduced by Basel 3

- 🛡️ Higher Capital Standards and their rationale

- 🛑 Introduction of Capital Buffers like the Capital Conservation Buffer (CCB) with a Practical Case Study of HDFC Bank

- 📈 CounterCyclical Capital Buffer (CCCB) with a Practical Case Study of Union Bank

- 💧 Liquidity Standards, including the Liquidity Coverage Ratio (LCR) with a Practical Case Study of Bank of India

- 💰 Net Stable Funding Ratio (NSFR) with a Case Study

Why Enroll in this Course?

- 🔍 Step-by-step explanation of the complex Basel Norms

- 🧑🏫 Special focus on practical Case Studies of leading banks like ICICI Bank, HDFC Bank, Union Bank, and Bank of India

- ✍️ Simple and lucid explanations of advanced topics

- 💡 Insight into the logic behind all the Basel norms

- 🤝 Emphasis on problem-solving with lots of questions to achieve concept clarity

This course is perfect for financial professionals, bankers, risk management specialists, and anyone interested in the regulatory landscape of banking. Enroll now to master the intricacies of Basel Norms and understand their practical implications in the banking sector! 🎓

Course Gallery

Loading charts...