Banking 101 - Risk Management & Asset Liability Management

Why take this course?

🚀 Course Headline: Banking 101 - Risk Management & Asset Liability Management

🧑🏫 Your Instructor: Jörg Marinko, an experienced financial expert and a passionate educator with a wealth of knowledge in banking operations, risk management, and asset liability management.

🚀 Course Description:

Are you intrigued by the world of finance and eager to understand how banks navigate through the complexities of risk management and asset liability management? Then "Banking 101 - Risk Management & Asset Liability Management" is your gateway to unlocking the secrets behind the scenes.

In this course, we embark on a comprehensive journey through the financial landscape where banks operate, a place where profitability and risk mitigation are not just goals but necessities for survival in an ever-changing environment.

What You'll Learn 📚:

-

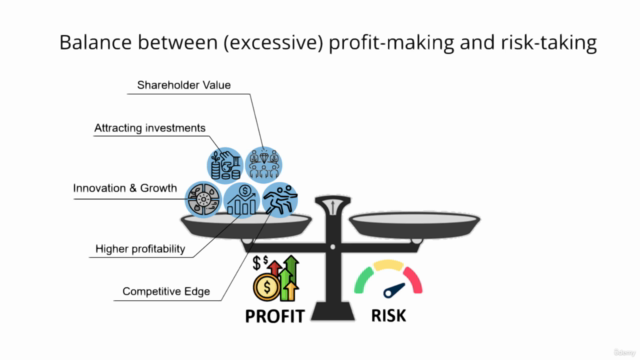

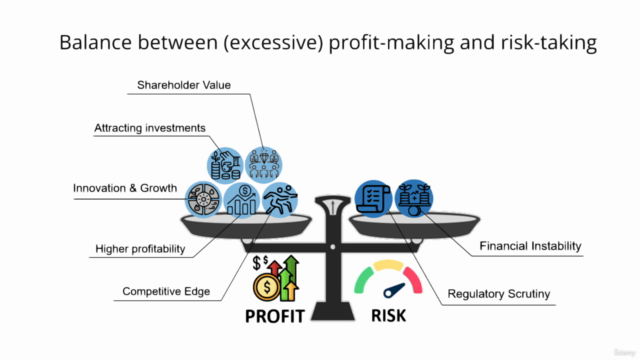

The Fundamentals of Bank Steering: We start with the basics to lay down a solid foundation for understanding how banks operate, focusing on the interplay between risk and asset liability management.

-

Deep Dive into Risk Management: Here we delve into the three main types of risks that financial institutions face - credit, market, and liquidity risks - and their critical role in shaping banking operations.

-

Mastering Asset Liability Management (ALM): Learn about the strategic approach to managing the assets and liabilities of a bank, ensuring long-term stability and profitability.

-

Funds Transfer Pricing (FTP) Explained: Discover how FTP influences a bank's pricing strategies for funds, impacting both profitability and risk management decisions.

-

Understanding Risk Bearing Capacity and Capital Adequacy: Get to grips with the concept of how much risk a bank can take on and why maintaining adequate capital reserves is crucial for absorbing potential losses.

-

Banking Regulation and Compliance: Navigate through the complex regulatory framework that governs banking operations, compliance requirements, and the critical role it plays in ensuring sound risk management practices.

Course Benefits:

✅ Enhance your understanding of how banks function and the importance of risk management.

✅ Gain valuable insights into the strategic planning involved in ALM to optimize a bank's balance sheet.

✅ Learn about the critical tools and techniques used by financial institutions for managing risks effectively.

✅ Understand the regulatory environment that shapes the banking industry and how compliance affects decision-making.

Whether you're a finance professional, a student aspiring to enter the world of finance, or simply someone interested in understanding the intricacies of banking, this course is your stepping stone to mastering risk management and asset liability management in today's financial sector.

Join us now and embark on a journey to become a proficient banker equipped with the knowledge to steer banks through the tides of the global financial markets! 🏦🌍

Enroll in "Banking 101 - Risk Management & Asset Liability Management" today and secure your future in the exciting world of finance. Let's navigate the complexities together with Jörg Marinko as your guide! 📚🚀

Course Gallery

Loading charts...