Anti-Money Laundering (AML) Business Risk Assessment

Why take this course?

🌟 Master Anti-Money Laundering (AML) Compliance: A Deep Dive into Business Risk Assessment with Vlad Karols 🌟

Your Goals and Profile 🚀

Choose our course if you aspire to:

-

Gain a comprehensive understanding of the categories of money laundering risks (a) associated with various customer types, services, geographical locations, and delivery channels.

-

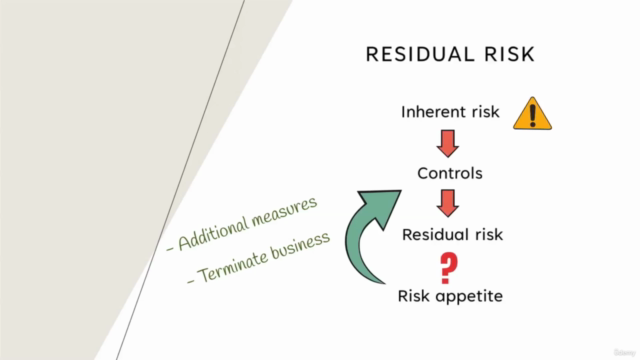

Master the AML risk management methodology (b), including evaluating the likelihood and impact of money laundering, conducting qualitative and quantitative analysis, understanding inherent vs. residual risks, and assessing control effectiveness against your company's risk appetite.

-

Learn the steps of carrying out an AML risk assessment (c) from identifying and assessing risks to defining control measures and evaluating residual risks within the context of your organization's risk tolerance.

-

Explore the vulnerabilities in particular industries and products (d), such as cash-intensive businesses, banking and fintech sectors, cryptocurrency services, corporate service providers, high-value goods trading, accountancy and tax advisory, legal professions, gambling sector entities, free-trade zones, and citizenship for investment programs.

-

Understand the typical mistakes made in entity-wide money laundering risk assessments to avoid common pitfalls.

The Sources of Information Used 📚

This course is grounded in best practices and guidelines from leading authorities, including:

- The Financial Action Task Force (FATF);

- The US Financial Crimes Enforcement Network (FinCEN);

- The Organisation for Economic Co-operation and Development (OECD);

- The Wolfsberg Group;

- The European Banking Authority (EBA);

- The International Compliance Association (ICA);

- And insights from the Basel Institute on Governance.

Why is our Course Different? 🤔

While there are numerous AML courses available, this course stands out by focusing exclusively on the critical aspect of any AML framework: the entity-wide AML business risk assessment. Unlike others that offer a broad overview, our course delves into the specifics, ensuring you have a deep and practical understanding of how to effectively conduct an AML risk assessment.

Additional Value for Money 💸

Our course goes beyond the basics with these unique features:

-

Interactive Quizzes: Test your knowledge with quizzes at each stage to ensure you understand the concepts discussed in the course.

-

A Customizable Spreadsheet Template for conducting AML risk assessments will be provided, saving you time and enhancing your risk management processes.

-

Extensive Additional Materials: Access a wealth of further reading materials to enrich your understanding and keep abreast of the latest developments in AML.

-

Upon successful completion, you will receive an official Certificate, showcasing your commitment and expertise to potential employers or clients.

What's Next? 🔄

Our commitment to comprehensive AML education extends beyond this course. Future offerings in our AML series will cover:

- Customer-level risk assessment, KYC, and customer due diligence (CDD) procedures.

- Ongoing transaction and customer relationship monitoring.

- Identifying risks related to politically exposed persons (PEPs), international sanctions, and dealing with high-risk or non-reputable jurisdictions.

- Internal and external reporting of suspicious transactions.

Join us on this journey to become an AML expert! 🕵️♂️💫

Course Gallery

Loading charts...