Algorithmic Trading & Quantitative Analysis Using Python

Why take this course?

🚀 Course Title: Algorithmic Trading & Quantitative Analysis Using Python

🔥 Course Headline: Build Fully Automated Trading Systems & Implement Quantitative Trading Strategies with Python!

Course Description:

Are you ready to dive into the world of high-frequency trading and algorithmic wizardry? In this comprehensive course, "Algorithmic Trading & Quantitative Analysis Using Python," you'll embark on an exciting journey to create your own fully automated trading bot on a budget that fits in your pocket! 💰

📊 What You'll Learn:

- Master Data Extraction: Learn to extract daily and intraday data for free using APIs and web-scraping techniques.

- Work with JSON Data: Gain proficiency in handling JSON data, a crucial skill for interacting with various financial services and APIs.

- Technical Indicators: Incorporate technical indicators into your trading strategy using Python's powerful libraries.

- Fundamental Analysis: Perform thorough quantitative analysis of fundamental data to make informed investment decisions.

- Value Investing: Discover how to apply quantitative methods for value investing, uncovering opportunities that may have been overlooked.

- Data Visualization: Visualize time series data effectively, making complex data sets easy to understand and interpret.

- Strategy Performance Measurement: Learn how to measure the performance of your trading strategies, ensuring you're on the right track.

- Python Backtesting: Incorporate and backtest your strategies using Python, one of the most versatile tools for financial data analysis.

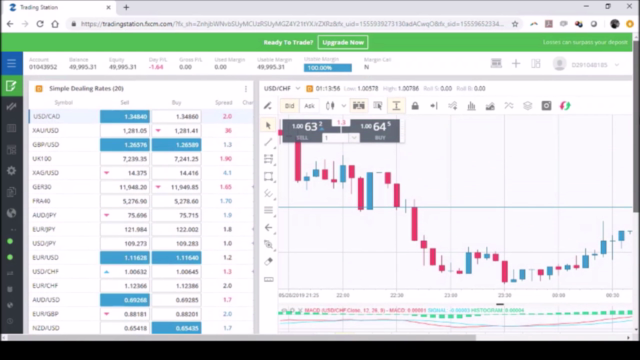

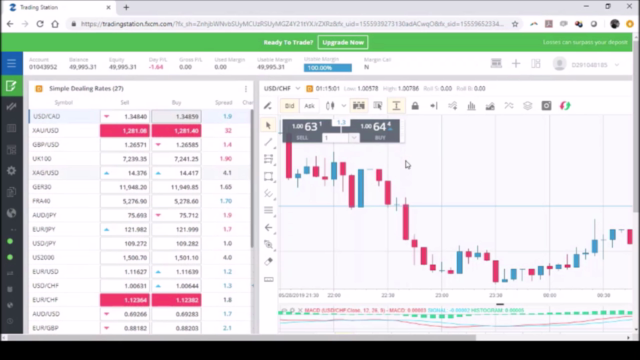

- API Integration: Seamlessly integrate your trading scripts with real-world APIs, such as those from FXCM and OANDA, to execute trades automatically.

- Sentiment Analysis: Understand the impact of market sentiment on your strategies and how to analyze it quantitatively.

🚀 Course Highlights:

- Real-World Application: Apply what you learn in real-time with hands-on projects and practical examples.

- Python Libraries: Get an introduction to essential Python libraries for quantitative analysis, such as pandas, NumPy, and Matplotlib.

- Quantitative Trading Strategies: Learn to develop and refine your own trading strategies using advanced quantitative techniques.

- API Trading Expertise: Familiarize yourself with API trading and how to automate trading signals.

- Complete Automation: Build a trading system that can operate with minimal human intervention, freeing up your time to focus on strategy development.

Why This Course?

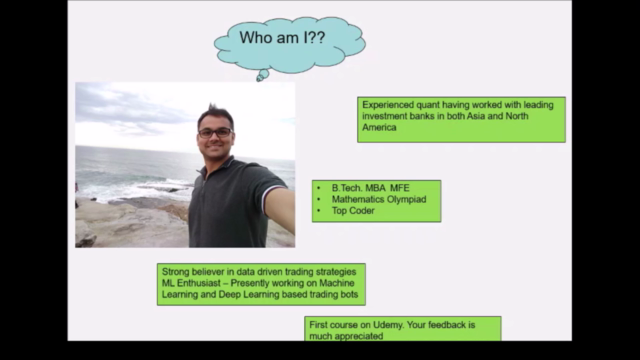

This course stands out for its comprehensive approach to algorithmic trading and quantitative analysis. With a focus on Python programming, you'll gain the skills to extract, analyze, visualize, and act upon financial data like a pro. You'll not only understand the theoretical underpinnings but also apply them in practice through API integration, backtesting, and strategy development.

Join us on this transformative learning adventure and unlock the full potential of algorithmic trading and quantitative analysis with Python! 📈✨

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

This Python-based algorithmic trading and quantitative analysis course caters to traders with varying backgrounds. While some errors exist, they don't overshadow the high-quality content, wide range of sources, and practical examples provided by an attentive instructor. An ideal option for those looking for affordable hands-on experience in building a fully automated trading system.

What We Liked

- Broad set of topics covered, relevant to both experienced and start-up traders.

- Code can be used 'out of the box' with minimum modifications required.

- Numerous free data sources provided for immediate use.

- Instructor is knowledgeable, passionate, and responsive to questions.

- Easy-to-follow, detailed explanations and practical code examples.

Potential Drawbacks

- Some errors found in demo code and videos; requires manual adjustments.

- Occasional focus on implementation over intuitive formula explanation.

- Font size of the code lines could be increased for better readability.

- Improvement can be made to include more diverse data sources

- Lacks certain machine learning algorithms and advance mathematical models.