Algorithmic Trading: Backtest, Optimize & Automate in Python

Why take this course?

🌟 Course Title: Algorithmic Trading: Backtest, Optimize & Automate in Python

🚀 Course Headline: Master the Art of Cryptocurrency Trading Automation with Python – From Zero to Algo Trading Hero! 🚀

Unlock the World of Automated Trading with Python!

Embark on a transformative journey into the realm of algorithmic trading. With this comprehensive online course, you'll harness the power of Python to create, test, and implement your very own cryptocurrency trading strategies. Whether you're a novice programmer or an experienced trader, this course will guide you step-by-step to automate your trading process, optimize for performance, and execute with precision.

What You’ll Learn:

📚 Understanding Open Source Tools:

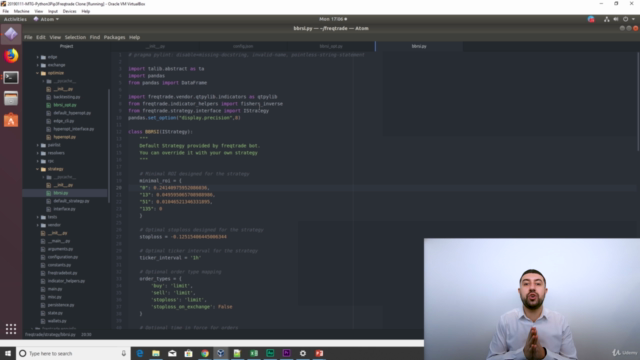

- Freqtrade: Discover how to leverage this powerful open-source trading tool, which is specifically designed for automated trading of digital currencies.

💻 Virtual Machine Setup:

- We provide you with a ready-to-use Virtual Machine, complete with all the necessary code and environments – no complex setup required!

🧠 Python Strategy Coding:

- Learn how to code your own trading strategy within Freqtrade.

- Access our repository filled with various strategies for inspiration and learning.

📈 Strategic Backtesting:

- Test your strategies against historical data to understand potential outcomes.

🔍 Optimization Techniques:

- Fine-tune your strategy parameters for optimal reward/risk ratios.

🔄 Walk-Forward Analysis:

- Minimize overfitting by evaluating your strategy with out-of-sample data.

💰 Paper Trading:

- Test your strategy in real-time with paper money to ensure it works as expected without risking actual funds.

💹 Live Trading with Real Money:

- Gradually transition to live trading when you're confident in your strategy's performance.

📱 Telegram Integration:

- Stay connected and in control of your trading algorithm from anywhere, using only your phone!

No Python Experience? No Problem!

If you're starting from scratch, fear not! Our course includes a comprehensive Python primer to get you up to speed with the essentials of Python programming. You'll be coding like a pro in no time!

Join a community of forward-thinkers and innovators who are already redefining the boundaries of financial trading. With this course, you'll gain the skills and confidence needed to fully automate your cryptocurrency trading strategy – all within Python's robust framework. 🐍

Enroll now and take the first step towards mastering algorithmic trading! 🌐💡

See you in the course, and let's embark on this exciting financial adventure together! 🚀📈🎉

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

This high-quality, content-rich algorithmic trading course targets intermediate learners seeking a structured approach towards automating their cryptocurrency strategies. The instructors' experience-based insights ensure comprehensive training on theoretical and practical aspects of the discipline. Despite its merits, the outdated course material causes compatibility issues with newer software versions. Thus lacking in up-to-date content, it may not deliver optimal value for beginners unfamiliar with programming basics or those seeking exposure to diverse trading strategies. Nevertheless, persevering students who navigate the dated examples could still significantly enhance their skills and knowledge base in algorithmic cryptocurrency trading—particularly if they have Python background, a knack for debugging outdated programs, and the ability to develop beyond the confines of this course.

What We Liked

- Comprehensive course covering theoretical and practical aspects of algorithmic trading using Python and the open-source tool Freqtrade

- Well-structured curriculum, commencing with Python basics and progressing to strategy optimization and automation

- Expert instructors provide in-depth explanations and experience-based tips throughout the course

- Active Q&A forum allowing students to interact with peers and gain additional support in their learning journey

Potential Drawbacks

- The course material is dated, causing compatibility issues between software versions and resulting installation problems for some students

- Lack of coverage on shorting strategies limits the scope of implementable trading techniques

- Freqtrade development constantly evolves, thus diminishing the course's relevance over time as updates are not forthcoming from instructors

- Linux and programming expertise prerequisites may pose challenges for those new to Python or trading algorithms