Advanced Options Trading in plain English

Why take this course?

Based on the course summary you've provided, here's a structured overview of the key topics covered in the options trading course:

-

Operational Considerations When Trading Options:

- Importance of an options trading plan.

- Impact of options expiration.

- Exercise and assignment process.

- Understanding pin risk and dividend risk.

-

Understanding Options Pricing:

- Application of the Delta-Gamma approximation formula.

- Formulas for at-the-money straddles and 20-delta strangles.

- Differentiating between intrinsic and extrinsic values.

-

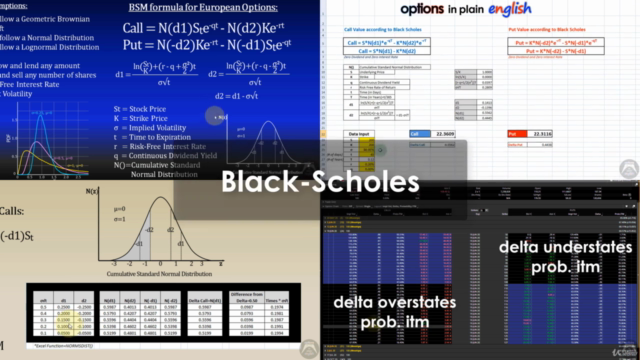

Introduction to the Black-Scholes Option Pricing Model:

- Principles of the Black-Scholes model.

- Explanation of why at-the-money delta is not exactly 50.

- Differences between delta and the probability of expiring in-the-money.

-

Volatility and Its Impact on Option Pricing:

- Understanding volatility skew and term structure.

- Impact on ratio spreads, delta-buster, and calendar spreads.

- How volatility affects option prices even when the direction is wrong.

-

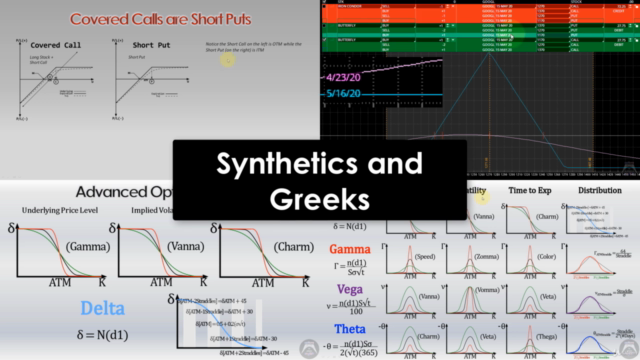

Put-Call Parity:

- Introduction to put-call parity.

- Applications like synthetic positions, box spreads.

- Impact of hard-to-borrow status on options pricing.

-

Synthetic Positions:

- Application of put-call parity to create synthetic positions.

- Explanation of condors, butterflies, and vertical spreads.

-

Advanced Option Greeks:

- Analysis of second and third order greeks (delta, vega, theta, gamma, etc.).

- Reaction of greeks to changes in underlying price, volatility, and time.

-

Options Strategies:

- Premium-selling strategies based on implied volatility and directional outlook.

- Earnings-related calculations and strategies.

- Stop-losses for options with zero days to expiration (0-DTE).

-

How to Trade the VIX:

- Trading the VIX using futures, ETFs, and ETNs.

- Understanding the impact of contango and backwardation on VIX products.

-

VIX Calculation and Settlement of VIX Futures and Options:

- What the VIX represents and its calculation process.

- Impact of the settlement process on VIX Futures and Options.

-

Adjusting and Rolling Options Positions:

- Managing existing options positions by adjusting or rolling them in response to market conditions.

-

Options Portfolio Management:

- Maximizing profits and minimizing risks through effective management of an options portfolio.

-

Differences Between Current P/L and P/L at Expiration for Options Strategies:

- Analyzing payoff diagrams to understand the interaction between underlying price, time to expiration, and implied volatility.

-

Top 10 Books on Options Trading:

- A list of influential books for beginners and advanced traders looking to improve their options trading skills.

-

Trading the Wheel:

- Understanding what the Wheel is, its application, pros, cons, and requirements for initiating this strategy.

This course appears to be comprehensive, covering both theoretical aspects of options trading and practical strategies for active traders. It emphasizes understanding the factors that affect option pricing, the use of greeks, and the management of options portfolios, as well as introducing specialized topics like the VIX and trading wheels.

Course Gallery

Loading charts...