Advanced Financial Modeling for Renewable Energy - ( US )

Why take this course?

🌱 Advanced Financial Modeling for Renewable Energy - Tax Equity Flip Structure

Course Objective 🚀

In an online environment, you will master the art of building a financial model suitable for advanced analysis of tax equity flip structures for wind and solar projects in the United States. This course provides step-by-step instructions on how to:

- Size tax equity investment

- Determine back-leverage loan terms

- Estimate the sponsor's equity return within a complex, real-life project finance model.

By the end of this course, you will be able to construct intricate financial models to meticulously analyze tax equity flip structures.

What This Course is About? 📊🌤️

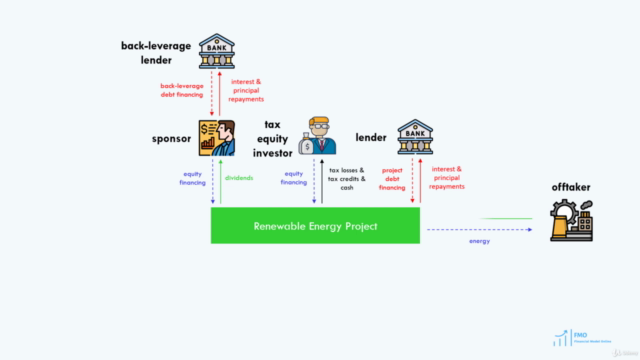

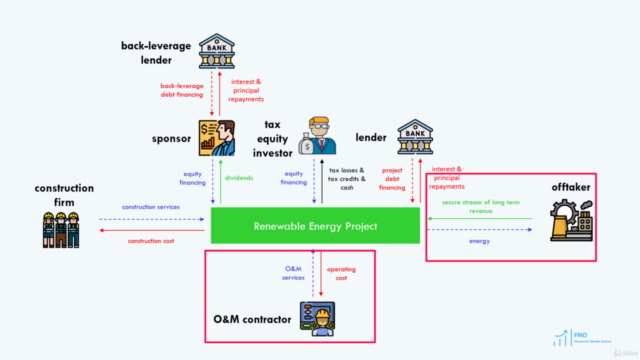

Project finance models are pivotal in assessing the risk-reward of lending to and investing in infrastructure projects. These models depend on the project's expected future cash flows, which we analyze through a financial model. In tax equity flip structures, additional complexities related to IRS tax rules must be accurately reflected in these financial models. This course will guide you through modeling a complex tax equity flip structure for wind and solar projects using Excel.

You will learn about: 🎓

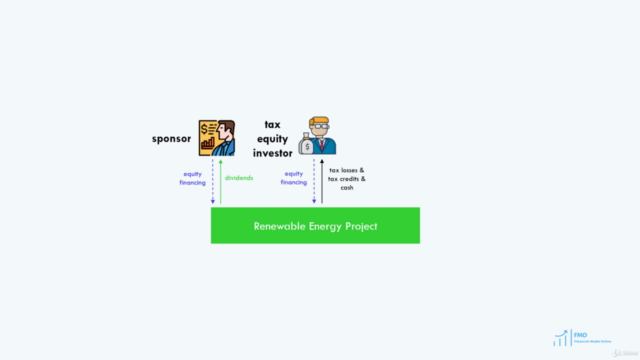

- Renewable Project Financing: Understanding the basics of how renewable projects are financed.

- Excel Macro & VBA Codes: Learning to create best practice macros and VBA codes to resolve circular references in Excel financial models.

- Sizing Debt: Applying covenants for wind and solar projects and sizing debt accordingly.

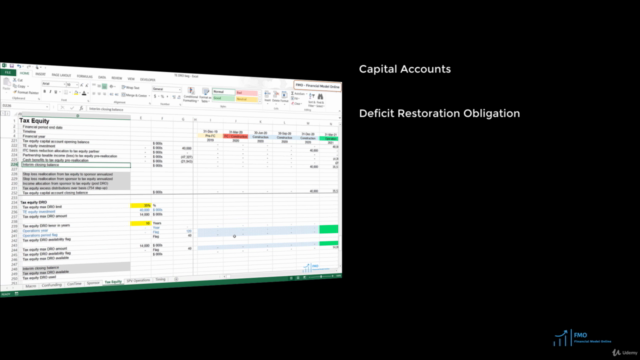

- Tax Benefits Allocation: Modeling the allocation of tax benefits between tax equity and the sponsor, including complex provisions like DRO and Qualified Income Offset.

- Tax Equity Investment Sizing: Understanding yield-based flips and optimizing your model to satisfy all parties involved—lender, sponsor, and tax equity investor.

- Development Process Insights: Gaining comprehensive insights into the financial modeling process for renewable energy projects.

How Does It Work? 🛠️

The course spans over 14 hours of detailed instruction:

- Renewable Energy Project Finance Overview: Understanding the essential components of a project finance transaction.

- Case Study Review: Analyzing a case study and learning efficient modeling methods in Excel.

- Building the Advanced Financial Model: From tax benefits allocation to cash distributions, we cover every aspect.

- Back-Leverage Loan Sizing: Modeling preliminary back-leverage loans and construction funding adjustments.

- Tax Equity Investment Modeling: Implementing IRS requirements and sizing the tax equity investment accurately.

- Sponsor's Cash Flow Calculations: Incorporating debt service reserve account (DSRA), default covenants, and debt service coverage ratio (DSCR) lock-up into the calculations.

- Scenario Analysis: Finding optimal tax equity transaction structures to enhance project value.

- Equity Return Modeling at Buyout: Understanding the accounting side of the tax equity transaction through HLBV accounting.

Is This Course For You? 🧐

This course is designed for anyone who needs to build, review, or analyze project finance models for wind and solar projects in the United States, especially:

- Analysts

- Managers and Senior Managers

- Associate Directors and Financial Advisors

- Financiers and CFOs

- from project companies, investment banks, private equity, and infrastructure funds.

Course Prerequisites 📚

Note: This is an advanced financial modeling course aimed at individuals who possess a solid understanding of modeling project finance for renewable energy projects. Most students typically take our other course "Project Finance Modeling for Renewable Energy" before diving into this advanced curriculum.

Enroll now to elevate your financial modeling skills to the next level and master the tax equity flip structure within the renewable energy sector! 🌞💪

Course Gallery

Loading charts...