Accounting Made Simple by 30 Examples

Why take this course?

🌟 Accounting Made Simple by 30 Examples 🌟 GroupLayout: Cem Bulut, your guide to unraveling the complex world of accounting with ease!

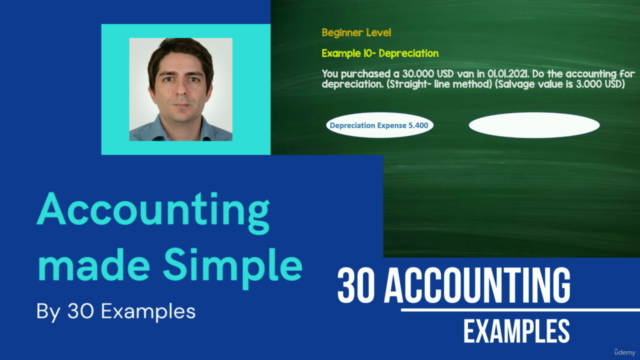

🎉 Course Headline: Beginner friendly with animations, examining bookkeeping entries. 🎉

🚀 Dive into the World of Accounting:

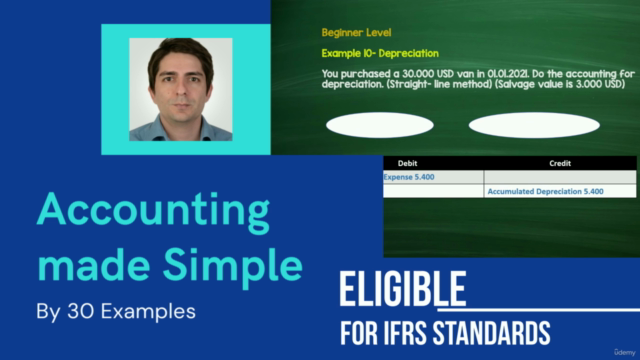

In this course, we'll break down the fundamental principles of accounting, making it accessible for beginners and a refresher for those who want to solidify their understanding. With 30 practical examples and engaging animations, you'll learn how to:

- Master Journal Entry Records: Learn the ins and outs of making accurate journal entries, understanding debit and credit transactions, and distinguishing between assets and liabilities.

📑 Explore Complex Entries: As we progress, we'll tackle more complex accounting scenarios. Don't hesitate to join us on this exciting learning journey! 😄

Course Contents:

- Cash Sale: Understand the journal entry for a cash sale transaction. (💸)

- Inventory Purchase: Learn how to record an inventory purchase. (📦)

- Fixed Asset Sale: Discover the process of selling a fixed asset and its implications. (🏗️)

- Service Sale: Uncover the accounting for selling a service, including the necessary journal entry. (✨)

- Bank Loan Usage: Explore the ins and outs of using a bank loan and its effect on your financials. (💰)

- Sales with Credit: Learn how to record sales when customers pay later. (⏰)

- Collection: Find out how to manage and collect receivables. (🔄)

- Bad Debt: Understand what journal entries are necessary when a debt goes uncollected. (🚫)

- Sales Discount: Learn about the accounting effects of selling products with discounts. (🤑)

- Depreciation (Straight Line Method): Get to grips with depreciation basics using the straight line method. (⏳)

- Compound Interest: Explore the power of compound interest over time. (♾️)

- Purchasing a fixed asset with interest rate: Learn how to account for the interest on a fixed asset purchase. (🔧)

- FIFO, LIFO & Weighted Average methods: Compare and understand the three major cost calculation methods. (📈)

- Sale with advance: Learn how to handle sales when payments are received in advance. (💳)

- Bad Debt allowance: Discover how to account for potential uncollectible accounts. (🚨)

- Calculating Inventory: Learn the methods to accurately calculate inventory levels. (📊)

- Cost of Goods Sold (Journal Entry): Understand how to record the cost of goods sold. (🛍️)

- Inventori Turnover Rate: Calculate this critical ratio for inventory management. (🏎️)

- Investment in available for sale securities: Learn about short-term investment accounting. (💎)

- Investment in another company (%20- %50): Account for investments that don't grant majority control. (🤝)

- Investment in another company (above %50): Understand the implications of holding a majority stake. (🌟)

- General Ledger: Get a comprehensive view of your company's financial activity with the general ledger. (📊)

- Depreciation (Declining balances): Learn an alternative depreciation method. (🏗️)

- Distribution of cash dividends: Understand how to distribute profits to investors. (💰➡️ Investors)

- Current Ratio: Calculate this key liquidity ratio for assessing short-term financial stability. (💧)

- Leverage: Learn about the financial leverage and its impact on a company's operations and risk profile. (⚖️)

- Receivable Turnover Rate: Analyze how efficiently a company collects its receivables. (🔄💳)

- Payable Turnover Rate: Understand the rate at which a company pays its liabilities. (🤝💵)

By the end of this course, you'll have a solid grasp of accounting fundamentals and be able to confidently navigate through various real-world scenarios with ease. Ready to conquer accounting? Let's get started! 🎓✨

Course Gallery

Loading charts...