A Beginners Guide to Financial Ratio Analysis

Why take this course?

🌱 Begin Your Financial Expertise Journey with "A Beginner's Guide to Financial Ratio Analysis" 🚀

Course Description:

Embark on a transformative learning journey with our comprehensive online course, "A Beginner's Guide to Financial Ratio Analysis." Designed for beginners and intermediate learners alike, this course will equip you with the knowledge and skills to understand and analyze financial statements through key ratios. 📊

What You'll Learn:

-

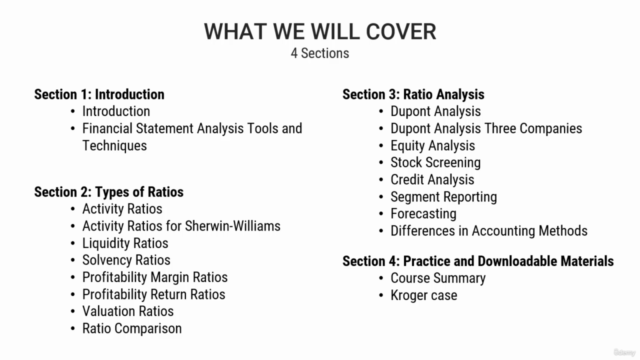

Activity Ratios: Dive into the dynamics of inventory management, receivables, and payables with metrics like accounts receivable turnover, days sales in accounts receivable, inventory turnover, days of inventory on hand, and accounts payable turnover. Master the cash conversion cycle to optimize your company's cash flow. 🏗️

-

Liquidity Ratios: Learn how to assess a company's ability to meet its short-term obligations with ratios such as the current ratio, quick ratio, cash ratio, and defensive interval. 💰

-

Solvency Ratios: Understand the long-term financial health of a business with debt-to-equity, debt-to-capital, interest coverage, fixed charge coverage, and other solvency ratios. 🏦

-

Profitability Ratios: Discover how to evaluate the efficiency and profitability of a company's operations through gross margin, profit margins, return on assets (ROA), return on equity (ROE), and more. 💸

-

Valuation Ratios: Learn to gauge a company's value with earnings per share (EPS), earnings yield, price-earnings ratio (P/E), dividend yield, dividend payout, and other valuation ratios. 📈

Hands-On Learning:

-

Real-World Analysis: Use real data from companies like Sherwin-Williams, Facebook, and Kroger to conduct a comprehensive financial analysis, including Dupont analysis, equity analysis, segment analysis, and credit analysis. 📊

-

Interpretation & Remedial Action: Interpret the results of your analysis and suggest actionable strategies to improve company performance. You'll learn how accounting choices can impact these ratios and what to watch out for. 🔍

-

Investment Screening: Apply the skills you've learned using stock screening software to find promising stock investments. 🚀

Course Resources:

-

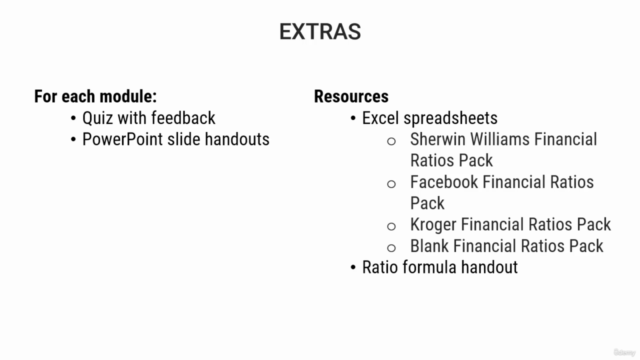

Interactive Modules: Engage with nineteen expertly crafted modules, each accompanied by quizzes and PowerPoint slide handouts to reinforce your learning. 📚

-

Financial Ratios Packs: Get your hands on spreadsheet financial ratios packs that compute all of the ratios for Sherwin-Williams, Facebook, Kroger, and a blank spreadsheet for you to explore with a company of your choice. 🧾

-

Ratio Handout: Use a detailed handout that provides a summary of all the ratios, including their computation for quick reference. 📐

Career Opportunities:

Upon completion of this course, you will be well-prepared to enter a variety of fields in accounting and finance, including but not limited to:

- Corporate Finance

- Investment Banking

- Private Equity

- Mergers & Acquisitions

- Hedge Fund Analysis

- Retail & Corporate Banking

- Business Development

- Financial Consulting

- Management Consulting

- Auditing (Internal and External)

- Risk Management

- Asset Management 🌟

Join us today and unlock the full potential of financial analysis! 🎉

Course Gallery

Loading charts...