Canadian T1 Personal tax preparation guide

Why take this course?

🧾 Canadian T1 Personal Tax Preparation Guide: Master the Art of TaxPrep T1 with Confidence!

🚀 Course Headline: Unlock the Secrets of Canadian Personal Tax with Our Comprehensive Online Course!

🎉 Who Will Benefit: This course is designed for a wide range of individuals, including:

- Those looking to expand their Taxprep T1 tax software knowledge.

- Individuals seeking a refresher on preparing T1 returns.

- New graduates and CPA students entering the public accounting field.

- Freelance bookkeepers aiming to broaden their services by offering T1 preparation.

📘 Course Description: Dive into the world of Canadian personal tax with our expertly crafted online course tailored for both beginners and seasoned professionals using Taxprep T1 software. This is your opportunity to master the intricacies of personal tax returns, from setup to submission. Whether you're a new grad, a CPA student, or a freelancer looking to expand your service offerings, this course will equip you with the knowledge and skills to confidently prepare personal tax returns.

🎓 Learning Objectives:

- Learn the end-to-end process of preparing a personal tax return using Taxprep T1 software.

- Get hands-on experience setting up a client file and mastering the Taxprep interface.

- Understand how to identify planning opportunities within a family profile.

- Claim non-refundable tax credits, including public transit, donations, medical expenses, tuition, textbook, and education amounts, student loans, and more.

- Work with various T slips for employment income, investment income, and other sources.

- Understand common T slips such as T3, T4, T4A, T5, T4RIF, T4RSP, T2202A, and T5013.

- Report capital gains & losses on the disposition of capital property.

- Handle investment income reporting.

- Deduct professional fees, carrying charges, child care expenses, and RRSP contributions.

- Record employment expenses and report self-employed business income and expenses.

- Handle rental income and expenses.

- Learn how to amend T1 returns and request a loss carryback.

🔍 Intermediate Personal Tax Topics:

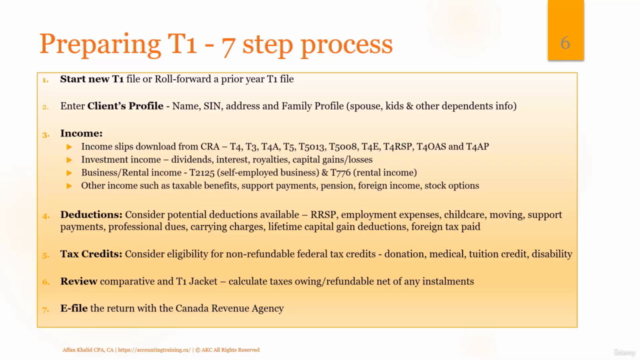

- A step-by-step guide to preparing T1 using the Taxprep 7-step process.

- Master client profiles, T slips, Federal Tax Credits, and T1 jackets and Schedules.

- Navigate complex schedules like 1, 3 (capital gains), 4 (investment income), 9 (donations and gifts), 11 (tuition and education amounts).

🌟 Advanced Personal Tax Topics:

- Delve into Statement of Business Activities (T2125#), Professional Activities (T2125#), Rental Income (T776#), Employment Expenses (T777), Child Care Expenses (T778), and more.

- Explore Allowable Business Investment Loss (ABIL), Net Capital & Non-Capital losses, RRSP deductions, Support payments, and other advanced topics.

💡 Tax Planning to Maximize Your Tax Refund:

- Optimize Child and Spousal Support.

- Understand the nuances of RRSPs, including rules and contribution limits.

- Maximize professional fees, child care expenses, and home office deductions.

- Take advantage of loss carry back and forward.

- Address Auto and Travel Expense issues.

- Explore the Lifetime Capital Gain Exemption and Capital Assets & CCA depreciation.

Join us on this journey to become a tax preparation pro! 🏆 With our comprehensive guide, you'll be well-equipped to tackle Canadian personal taxes with confidence and precision. Sign up today and transform your tax season into a success story!

Course Gallery

Loading charts...